Home /

Money Blog

A Fabulous Offer

Note: You can use any financial calculator to do this problem, but if you want the BEST, you can

get our

10bii

Financial Calculator for iOS, Android, Mac, and Windows!

THE SCENARIO

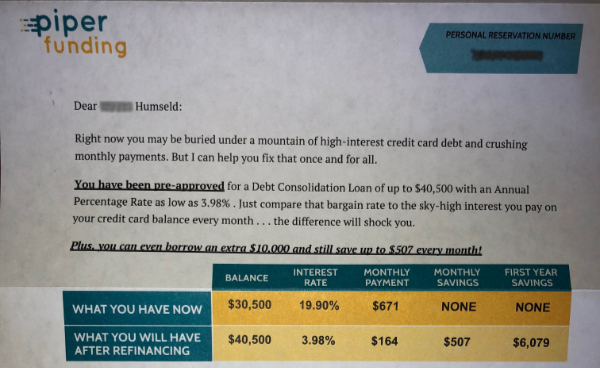

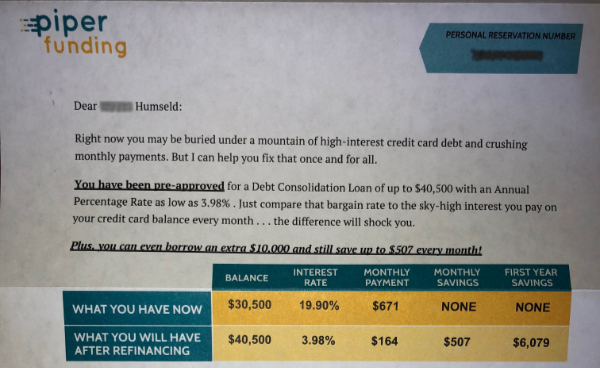

I (or someone with a name that's pretty close to mine) got a refinance offer this week, this time from Piper Funding. They're offering to do a debt consolidation loan because they think I have $30,500 in credit card debt at 19.90% interest. They're as wrong about that as they are about how to spell my name, but I thought it'd be interesting to figure out one of the details that they didn't mention in their offer.

They want to give me a loan for $40,500 at 3.98% interest, with a payment of $164 per month. I don't need to consolidate any debt, but I might be interested in borrowing money at 4% because I think I can probably make more than 4% with it. Regardless of whether or not I want to borrow the money, it's important for me to understand the terms of the loan.

The question: If I were to take them up on the offer as presented in their letter, how long would it take me to pay off the loan if I just made the regular payment every month?

THE SOLUTION

This one is pretty straightforward.

First things first, make sure the calculator is using 12 Payments per Year.

N: (This is what I'm trying to find)

I/YR: 3.98% (The loan they're offering carries a 3.98% interest rate)

PV: 40,500 (They want to lend me $40,500)

PMT: -164 (They state that my monthly payment will be $164)

FV: 0 (I want to pay the loan off completely)

Though not stated in the loan offer, I've determined that it'll take me 516.30 months (43 years) to pay off the loan.

What do you think? If someone were willing to lend you $40K at 4% for 43 years, would you take them up on that offer? Why or why not? What would you do with the money, and do you think you could make it pay for itself? Let us know in the comments!