THE SCENARIO

John and Jane Smith want to retire in 12 years, they currently have $250,000 invested in a bond fund earning 2.8%, and they need $875,000 to retire. Their house payment is $1,330, and they currently owe $97,500. It will be paid off in 12 years.(7% borrowing rate)They're considering refinancing their house (to a 15-year loan at 3.5%) to free up more cash on a month-to-month basis.

THE QUESTION

They're not comfortable with owing more than they currently do, so they want to take out the 3.5%, 15-year loan, but they only want the opening balance to be their current $97,500.

A) If they do this, what's their new payment?

B)How much money would this free up per month?

C)How much will they still owe after 12 of the 15 years of the new loan?

D)How much will they need at the end of 12 years if they want to pay off their mortgage when they retire?

E)If they invest the extra money they're saving on their house payment each month, along with the $250,000 they've currently got saved,what yield would they needto reach their goal?

F) If they invested an extra $250 beyond their house payment savings each month, what yield would they need to reach their goal?

THE SOLUTION

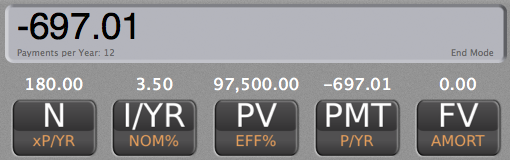

A)If they do this, what's their new payment?

N = 180

I/YR = 3.5%

PV = $97,500

FV = $0

PMT = -$697.01

Their new payment is $697.01 per month.

B)How much money would this free up per month?

Current payment = $1,330

New payment = $697

Difference = $1,330 - $697.01 = $632.99

Doing this refinance would free up $632.99 per month.

C)How much will they still owe after 12 of the 15 years of the new loan?

N = 144

I/YR = 3.5%

PV = $97,500

PMT = -$697.01

FV = -$23,797.07

At the end of the next 12 years, they will still owe $23,797.07 on their new loan.

D)How much will they need at the end of 12 years if they want to pay off their mortgage when they retire?

$875,000 + $23,797.07 =$898,797.07

If they want to pay off their house when they retire and have $875,000 left over, they need to have $898,797.07 in their investment account when they retire.

E)If they invest the extra money they're saving on their house payment each month, along with the $250,000 they've currently got saved,what yield would they needto reach their goal?

N = 144

PV = -$250,000

PMT = -$633

FV = $898,797.07

I/YR = 9.02%

They would need to get 9.02% yield on their investment.

F)If they invested an extra $250 beyond their house payment savings each month, what yield would they need to reach their goal?

N = 144

PV = -$250,000

PMT = -$883

FV = $898,797.07

I/YR = 8.38%

Their yield would need to be 8.38%.