THE SCENARIO

Working with a note broker, I find a note that I can purchase. The terms of the note are as follows:

THE QUESTION

A) If you had determined that you needed a 11% return on your money, what monthly payment would you need to receive to get that yield?

B)If you lowered the borrower's monthly payment to that amount, what would their new borrowing rate be? Note that in this scenario, there's no principal forgiveness; they still owe the same amount.

C)If the borrower gets onto this new payment plan for 14 months, then stops paying again.What do they owe after the 14 months of payments?

THE SOLUTION

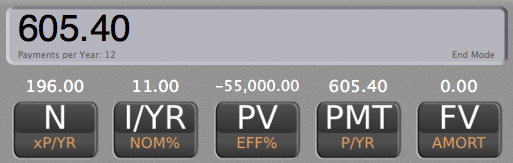

A) If you had determined that you needed a 11% return on your money,what monthly payment would you need to receive to get that yield?

N = 196

I/YR = 11%

PV = -$55,000

FV = $0

PMT = $605.40

You would need to get $605.40 per month to get an 11% yield.

B)If you lowered the borrower's monthly payment to that amount, what would their new borrowing rate be? Note that in this scenario, there's no principal forgiveness; they still owe the same amount.

N = 196

PV = $90,655.15

PMT = -$605.40

FV = $0

I/YR = 3.44%

Their new borrowing rate would be 3.44%.

Doing this would speed up their amortization, get you the yield you need, and make it unlikely that the borrower would be able to refinance at a lower rate.

C)If the borrower gets onto this new payment plan for 14 months, then stops paying again.What do they owe after the 14 months of payments?

N = 14

I/YR = 3.44%

PV = $90,665.15

PMT = -$605.40

FV = -$85,730.96

After paying for 14 months, they owe $85,730.96.