Okay, time for part 2. To recap, the scenario from Part 1 is as follows:

THE SCENARIO

I came across a note for sale. The terms of the note are as follows:

Original balance: $6,000

Unpaid balance as of June 2: $4,560

Term: 5 years

Interest Rate: 0

Payments: $100 per month

If I buy it, make the purchase on June 2, and the first payment I'll receive will be the July payment.

Every February, the borrower pays off $1,000 in order to accelerate the note paydown.

QUESTION

If I buy the note for its face value ($4,560), what will my yield (or Return On Investment, or the Internal Rate of Return of the deal) be?

SOLUTION

Note: This requires Uneven Cashflows. Don't freak out, it's going to be okay.

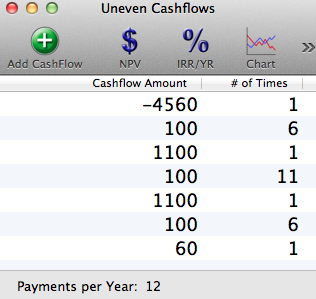

Uneven Cashflow Setup:

Initial Cashflow = -$4,560

Payments of $100 times 6

Payment of $1,100 times 1

Payment of $100 times 11

Payment of $1,100 times 1

Payment of $100 times 6

Payment of $60 times 1.

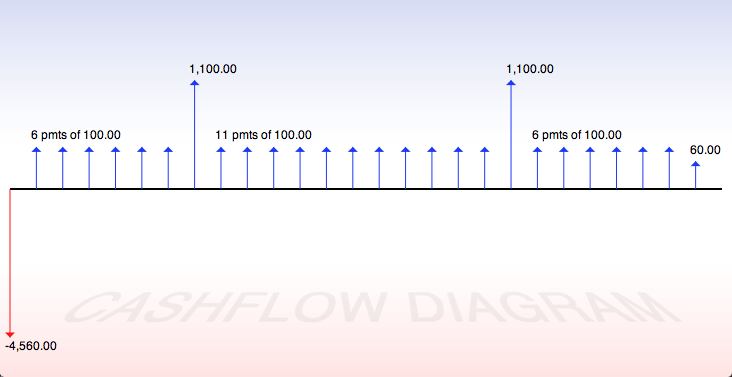

Graphically, the setup looks like this:

The Cashflow daigram looks like this:

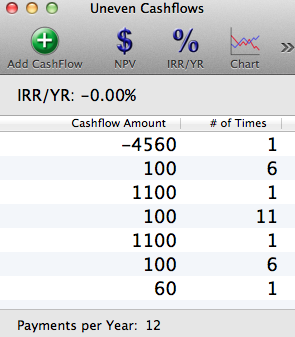

Solving for IRR/YR, I find that if I buy the note at no discount, my yield is 0.00%.

Not as impressive as I'd like, but it makes sense since the note is written at 0% interest.